Inflation: The Silent Killer

In the not-so-distant future, retirees and pre-retirees watch in horror as their carefully planned financial plans unravel. The cost of living had quietly doubled, turning once-comfortable pensions into barely enough to scrape by. Replacing their dream of a relaxed retirement with the unsettling reality that the money they saved might not last as long as them. The cause for such horror is inflation.

The biggest killer of any financial plan is inflation. Many people forget how inflation can deplete your savings over time. This horror story doesn’t have to happen to you if you plan for inflation now!

Learn More: Inflation & Recession: 7 Podcast Episodes You Should Hear

What is inflation and what causes it?

Inflation is the decrease in the dollar’s purchasing power, reflected in a general increase in the prices of goods and services. As inflation rises, each dollar you have buys less, meaning that eventually, you need more money to purchase the same items. Understanding and planning for inflation is crucial, especially in long-term financial strategies like retirement planning.

The shrinking power of a $1:

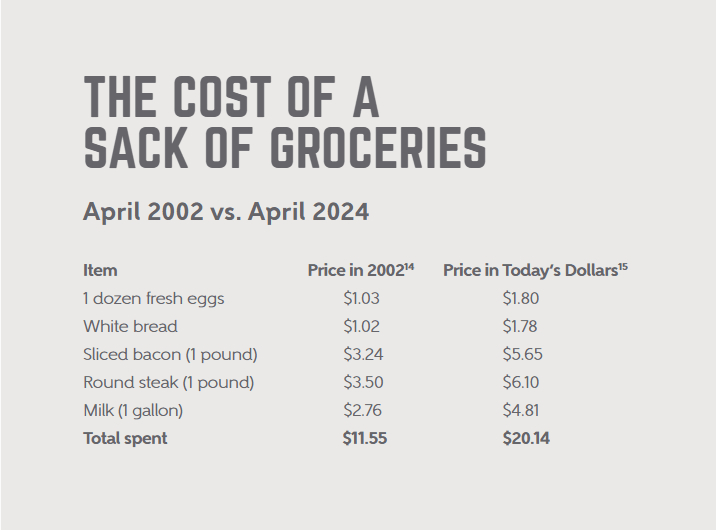

A great way to illustrate inflation is by comparing the cost of everyday items from the past to today’s cost.

Lumber – 1,000 board feet:

- 1974 – $130

- 2004 – $401

- 2024 – $446

14 Ben Wittstein. Stacker.com. Nov. 17, 2020. “The cost of goods the year you were born.” https://stacker.com/stories/1227/

cost-goods-year-you-were-born. Accessed June 20, 2024.

15 U.S. Bureau of Labor Statistics. “CPI Inflation Calculator.” https://www.bls.gov/data/inflation_calculator.htm. Accessed June 20, 2024.

What does inflation mean for your retirement?

Inflation affects nearly everything, and your retirement is no exception! One of the biggest challenges in retirement is adjusting to the lack of a regular paycheck as your source of income shifts. Start by, planning for inflation now, so you can, approach retirement with confidence. Taking proactive steps today will help ensure your retirement savings maintain their value and support your desired lifestyle.

Here is a helpful U.S. inflation calculator that you can use to understand the impact of inflation on your retirement planning. 210 Financial is offering a free guide to help you prepare for the increasing costs associated with inflation.

6 Things you can do to prepare for inflation:

While there is no magic potion to completely protect your finances from inflation there are some strategies you can put in place to help limit inflation’s impact.

- Diversify Your Portfolio: A diversified portfolio can help mitigate market volatility. Inflation hits liquid assets the hardest, but it can also affect fixed-income investments. By spreading your investments across various asset classes, you can better protect your finances from rising inflation.

- Consider Equity Stocks That Pass Through Increased Earnings: Equity stocks that can pass along increased costs to consumers often outperform the market during inflation. This strategy can help your investments keep pace with or even outpace inflation.

- Seek Strategies That Provide Guaranteed Income: Ensuring a portion of your retirement income is guaranteed, like annuities or other income-generating products, can provide stability even during inflation.

- Don’t Get Too Comfortable with Cash: Inflation erodes the purchasing power of cash. To counter this, consider allocating funds to different accounts and investments rather than keeping too many liquid assets. Diversifying where you hold your money can help maintain its value over time.

- Spend Wisely: Take a closer look at your budget to see if it can withstand the effects of inflation over the years. You may need to adjust your spending habits to reduce inflation’s impact on your finances.

- Meet with Your Financial Advisor: Finally, discuss with your financial advisor how to prepare for inflation based on your unique situation. They can provide personalized advice and strategies to help protect your retirement from the effects of rising inflation.

Meet with 210 Financial!

By implementing these strategies, you can better manage the impact of inflation on your retirement and maintain your financial security.

Conclusion:

In the shadowy corners of your financial future, a silent killer lurks—inflation. It creeps up slowly, quietly draining the value of your hard-earned savings, threatening to turn your golden years into a nightmare. But fear not! With the right plan, you can keep this monster at bay.

Think of diversifying your portfolio as fortifying your defenses, while seeking guaranteed income is like arming yourself with a silver bullet. Don’t let the comfort of cash lull you into a false sense of security—inflation feeds on complacency. And remember, your financial advisor is like a guide through a dark forest, helping you navigate the dangers ahead.

Don’t let inflation turn your retirement dream into a chilling horror story—prepare now and keep the terror at bay.

210 Wealth Management, Inc., d/b/a 210 Financial, is a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. 210 Financial, Form ADV Part 2A & CRS can be obtained by visiting: https://adviserinfo.sec.gov and search for our firm name. Insurance products are offered through 210 Financial, Inc. d/b/a 210 Financial.

Ready to Take The Next Step?

For more information about our comprehensive financial planning process, schedule a meeting or register to attend an event.