Blueprint to a Relaxed Retirement: 5 Essential Pillars of the 210 Financial Plan

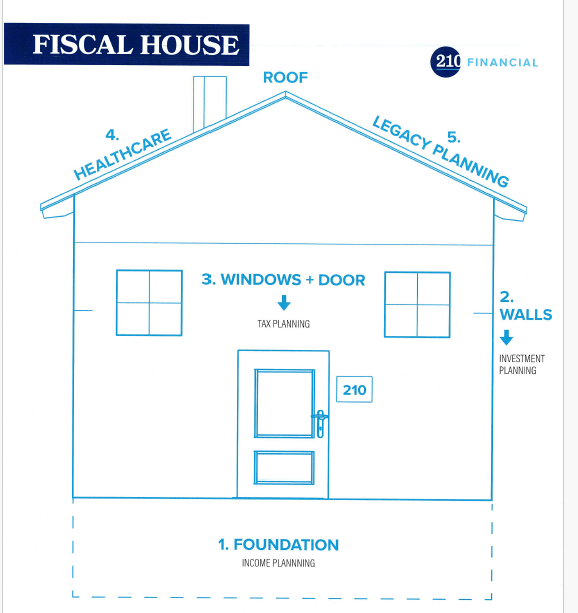

Building a home is a process that requires time, dedication, and hard work. At 210 Financial, we approach retirement planning with the same dedication. Just as a home is carefully constructed, our Retirement Blueprint process helps ensure you’re thoroughly prepared for retirement.

We create a comprehensive, personalized plan to secure a comfortable retirement for our clients. Let’s walk through the five financial pillars of 210 Financials’ Retirement Blueprint, serving as the foundation for a well-structured and secure retirement strategy.

Pillar 1: Income Planning:

Income planning is the foundation of a house, it’s the ground in which you can build upwards. The income planning process involves determining how much money you’ll need to retire comfortably. It’s about understanding your unique lifestyle needs and financial goals. Consider what it takes for you to live comfortably in retirement. Do you want to travel? Make sure to budget for those adventures. Planning to donate to your favorite charities? Include those contributions in your financial strategy. Thinking about making a significant purchase? Factor that into your retirement plan. Effective income planning helps you ensure that you have the resources to fulfill your dreams and maintain your desired lifestyle throughout retirement.

Now that you’ve envisioned your desired lifestyle determine all possible income sources. It could be pensions, social security, and other income streams. When you know the monthly income you will need to retire and how much money you will have coming in you can build the foundation of your retirement home.

Need help planning? Speak with a financial advisor today!

Pillar 2: Investment Planning:

Our second retirement blueprint pillar is investment planning, serving as the walls of your home. As part of your 210 Retirement Blueprint, our 210 Financial team will assist with managing your investments so you can continue growing your wealth. Some of these investment accounts include:

- 401(k)s: Employer-sponsored retirement plans that offer tax-deferred growth.

- 403(b)s: Like 401(k)s but designed for employees of public schools and certain non-profit organizations.

- Traditional IRAs: Tax-deferred accounts where contributions may be tax-deductible.

- Roth IRAs: Accounts funded with post-tax dollars, allowing tax-free withdrawals in retirement.

- Brokerage Accounts: Non-retirement investment accounts that provide flexibility in investment choices.

Our approach focuses on asking a few important questions to start. From these questions, we can better grasp your investment goals and create a tailored plan to possibly grow your dollars.

- Are you happy with your investment decisions?

- How do you feel about taking risks?

- What are your investment goals?

Take some time to think about these questions and how you would answer them. These questions can help you gauge where you are and where you want your finances.

Learn More: How Stocks and Bonds Can Brighten your Finances

Pillar 3: Tax Planning:

Another vital retirement planning pillar to consider is tax planning, serving as the doors and windows to your house. Taxes don’t go away in retirement, so you must plan for them whichever way they go. It’s useful to look at tax-advantage accounts when saving for retirement to help you avoid paying more money in taxes.

- Capital gains

- Estate

- Income

- Etc.

Tax planning is so important that the very first episode of The Retirement Blueprint Podcast talks about preparing for tax season.

Learn More: Watch or listen here!

Pillar 4: Health Care Planning:

As we age, more health-related issues occur, and with that, our finances are bound to deteriorate. That’s why healthcare planning is essential to a well-rounded retirement plan and serves as part of our roof. Knowing what coverage options you have with Medicare and planning for long-term care is something to insert into your financial plan. Healthcare planning is another pillar of our Retirement Blueprint process. We will possibly help ensure that your healthcare needs are covered and that you’re prepared for potential long-term care expenses, providing peace of mind and stability in your golden years.

Learn More: Navigating Healthcare Costs in Retirement: What You Need to Know

Pillar 5: Legacy Planning & Insurance:

The final pillar of the retirement blueprint is legacy planning and insurance and finishes up our house with the other half of the roof. This pillar addresses what happens after you’re no longer here, making it a crucial part of planning if you want to leave a lasting impact on your loved ones or charitable causes.

Life insurance plays a vital role in this process by ensuring that your beneficiaries are financially protected. It’s important to consider what you wish to leave behind—whether it’s for family, friends, or charities—and to plan accordingly. This involves understanding the tax implications, deciding how your assets will be divided, and ensuring your wishes are communicated. Effective legacy planning ensures that your financial legacy reflects your values and provides support to those you care about.

Learn More: Why You Should Get Serious About Life Insurance – Episode 21

Conclusion:

These five essential pillars are all covered in our complementary Retirement Blueprint process. In our process, we dive into each of these to help build you a personalized plan. Looking into each of these pillars can help you build the retirement home of your dreams. Schedule your Retirement Blueprint meeting today to personalize your retirement!

210 Wealth Management, Inc., d/b/a 210 Financial, is a federally registered investment adviser under the Investment Advisers Act of 1940. Registration as an investment adviser does not imply a certain level of skill or training. The oral and written communications of an adviser provide you with information about which you determine to hire or retain an adviser. 210 Financial, Form ADV Part 2A & CRS can be obtained by visiting: https://adviserinfo.sec.gov and search for our firm name. Insurance products are offered through 210 Financial, Inc. d/b/a 210 Financial.

Ready to Take The Next Step?

For more information about our comprehensive financial planning process, schedule a meeting or register to attend an event.