Will Social Security Be There For Me?

Do you ever feel concerned about the future of Social Security? In today’s article, we have an adapted excerpt from 210 Retirement Blueprint: Finding Your 210 Life, a new book by our very own Phil Cooper, to address that concern. Grab your copy for more on this topic and much more!

“Will Social Security be there for me?”

This question may be on your mind as it continually pops up in headlines that point to an underfunded Social Security program, along with the sea of baby boomers retiring in droves, and the comparatively smaller pool of younger people who are bearing the responsibility of funding the system.

Even the Social Security Administration acknowledges this concern as each Social Security statement now contains a link to its website and a page entitled, “Will Social Security Be There For Me?”

It’s a valid concern to have. Depending on who you’re listening to, Social Security funds may run low before 2034 as a result of the financial instability and government spending that accompanied the 2020 COVID-19 pandemic. But what does that mean for your retirement plans? Will there even be Social Security left for you when you retire in five, ten, or fifty years from now?

The Future of Social Security

These questions are important to consider when you look at how much we, as a nation, rely on this program. Did you know that according to the Social Security Administration, Social Security benefits replace about 40% of a person’s original income when they retire? (Social Security Administration. April 2021. “Can You Take Your Benefits Before Full Retirement Age?” https://ssa.gov/planners/retire/applying2.html) If you ask me, that’s a pretty significant piece of your retirement income puzzle.

Before you get too discouraged though, there are a few things that can give you comfort about the future of social security:

- Even if the program is only paying 78 cents on the dollar for scheduled benefits, that is a whole lot more than zero!

- The Social Security Administration has made changes in the distant and near past to protect the fund’s solvency, including increasing retirement ages and striking certain filing strategies.

- There are many changes Congress could make and lawmakers are currently discussing how to fix the system, such as further increasing full retirement age and eligibility.

- No one is seriously discussing reneging on current obligations to retirees or the soon-to-retire. So if you are retiring soon, your benefits should be relatively secure and if you are retiring in the next 10 years, you still have time to make adjustments to secure your retirement.

It is true that there are some concerns in the future regarding Social Security, but the answer to the question of will Social Security be there for me is a resounding yes. It may not be at the same capacity as it was originally intended, but it will still be there for you at some amount.

Why You Need to Know About Full Retirement Age

While Social Security benefits will still play a significant role in your retirement plan, it’s important you understand how to make the most of it.

Some people want the highest possible monthly benefit. Others want to start their benefits early, and not always because of financial need. It’s common knowledge that you can begin your benefits at age sixty-two and that’s what many of us do. What many people fail to understand is, by starting benefits early, they may be leaving a lot of money on the table.

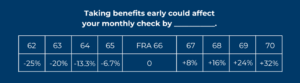

The Social Security Administration bases your monthly benefit on two factors: your earnings history and your full retirement age (FRA). While your specific FRA may be a bit of a moving target that changes based on the year you were born, we have a handy chart to help.

Social Security Administration. April 2021. “Can You Take Your Benefits Before Full Retirement Age?” https://ssa.gov/planners/retire/applying2.html

When you reach FRA, you are eligible to receive 100% of whatever the Social Security Administration says is your full monthly benefit.

Here’s where you’ll start to see variations to that amount depending on when you start taking your benefit. Starting at age 62, for every year before FRA you claim benefits, your monthly check is reduced by 5% or more. Conversely, for every year you delay taking benefits past FRA, your monthly benefit increases by 8% (until age 70–after that, there is no monetary advantage to delaying Social Security benefits). While your circumstances and needs may vary, a lot of financial professionals still urge people to at least consider delaying until they reach age 70.

The United States Social Security Administration. (n.d.). https://www.ssa.gov/planners/retire/applying2.html

While we don’t know the exact capacity Social Security will be at when you retire, it’s clear that lawmakers and the Social Security Administration are taking action to preserve your benefits.

If you want to learn more about Social Security, planning for retirement, and more, be sure to pick up your copy of 210 Retirement Blueprint: Finding Your 210 Life.

Investment advisory products and services made available through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. Our firm is not affiliated with the U.S. government or any governmental agency. The information is not intended to be used as the sole basis for financial decisions, nor should it be construed as advice designed to meet the particular needs of an individual’s situation. 1905735-7/23

Content prepared by Savage Content Collective

Ready to Take The Next Step?

For more information about our comprehensive financial planning process, schedule a meeting or register to attend an event.

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out:

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out: