Is Your Plan as Distinguished as You Are?

At 210 Financial, we’re tuned in to what women want for their financial lives, both now and in the future. Whether their goals include putting children and grandchildren through college, caring for aging parents or living the retirement lifestyle they’ve always pictured, we help women turn those goals into reality.

Yet many women aren’t taking control of their finances. A recent UBS study found that nearly five in 10 women still defer financial matters to a spouse.1 But with increased longevity and divorce rates, the likelihood that women will end up solely responsible for managing their money at some point is high. Women are also more likely to face unique challenges, including:

Despite an increased presence in the workforce, the average woman working full time earns 84% of the income earned by men.2 Reduced wages lead to lower savings for retirement, leaving many women with a shortfall in their later years.

On average, females who reach age 65 outlive their male counterparts by almost three years.3 These longer lifespans mean women need more savings to ensure they don’t run out of income in retirement.

Women are more likely to leave the workforce to care for growing families, aging parents or ailing spouses than men. While serving as a caregiver is gratifying, it’s also unpaid.

The 210 Financial team understands what women want from retirement — and we’re committed to helping ensure every woman’s financial needs are met. We’ll help you face the future confidently, knowing you’ve addressed all the “what ifs” the future may hold.

When you work with us, we’ll walk through your financial goals and create a plan to help you reach them. During our three-part Retirement Blueprint process, we’ll show you:

Exactly where you stand

We’ll examine your current strategy, looking at your investments, savings and goals.

How well you’re protected

We’ll determine how well you’re equipped to address what we believe are five crucial areas of retirement.

Where to go next

We’ll help you figure out how to move forward to create a financial plan that fits your life.

Go Figure!

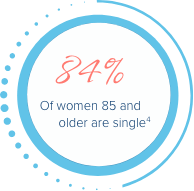

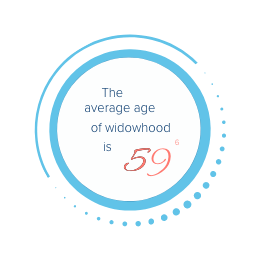

Key statistics and numbers related to women:

When it comes to retirement planning, many people want:

- Peace of mind knowing they have enough money to get through retirement

- A sense of security for them and their families

- Legacies that span generations

210 Financial knows what women want from their finances — and we’re here to help you along the way.

When it comes to retirement planning, many people want:

- Peace of mind knowing they have enough money to get through retirement

- A sense of security for them and their families

- Legacies that span generations

210 Financial knows what women want from their finances — and we’re here to help you along the way.

Retirement Blueprint Review today

by calling 309.263.1333, emailing office@210Financial.com or simply clicking the button below!

1 Own Your Worth 2022. Women on Purpose: Values, money and the pursuit of more intentional lives.” https://www.ubs.com/us/en/wealth-management/specialized-advice/women-and-finances.html. Accessed May 25, 2022.

2 Amanda Barroso and Anna Brown. Pew Research. May 25, 2021. “Gender pay gap in U.S. held steady in 2020.” https://www.pewresearch.org/fact-tank/2021/05/25/gender-pay-gap-facts/. Accessed March 28, 2022.

3 SocialSecurity.gov. “Retirement & Survivors Benefits: Life Expectancy Calculator.” https://www.ssa.gov/oact/population/longevity.html. Accessed March 28, 2022.

4 Federal Interagency Form on Aging Related Statistics. Oct. 14, 2020. Page 5. “Older Americans 2020: Key Indicators of Well-Being.” https://agingstats.gov/docs/LatestReport/OA20_508_10142020.pdf. Accessed March 28, 2022.

5 Ted Jenkin. CNBC.com. May 10, 2022. “Women are gaining power when it comes to money - here’s why that’s a big deal.” https://www.cnbc.com/2022/05/03/money-decisions-by-women-will-shape-the-future-for-the-united-states.html#:~:text=This%20massive%20change%20over%20the,total%20U.S.%20household%20financial%20assets. Accessed May 19, 2022.

6 Kathleen M. Rehl. CNBC. March 6, 2020. “Recent widows need financial guidance after a spouse’s death.” https://www.cnbc.com/2020/03/06/recent-widows-need-financial-guidance-after-a-spouses-death.html#:~:text=I%20fit%20the%20norm.,their%20husbands%20by%2015%20years. Accessed April 12, 2022.

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out:

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out: