A 5-Part Blueprint for Retirement

A good retirement plan is like having a well-thought-out blueprint for building a house. When you have a solid plan, you can know that your house will weather most any storm. You would likely never dream of trying to build a house from scratch without a detailed plan of how all the pieces were going to fit together, and the same should be true of your retirement plan.

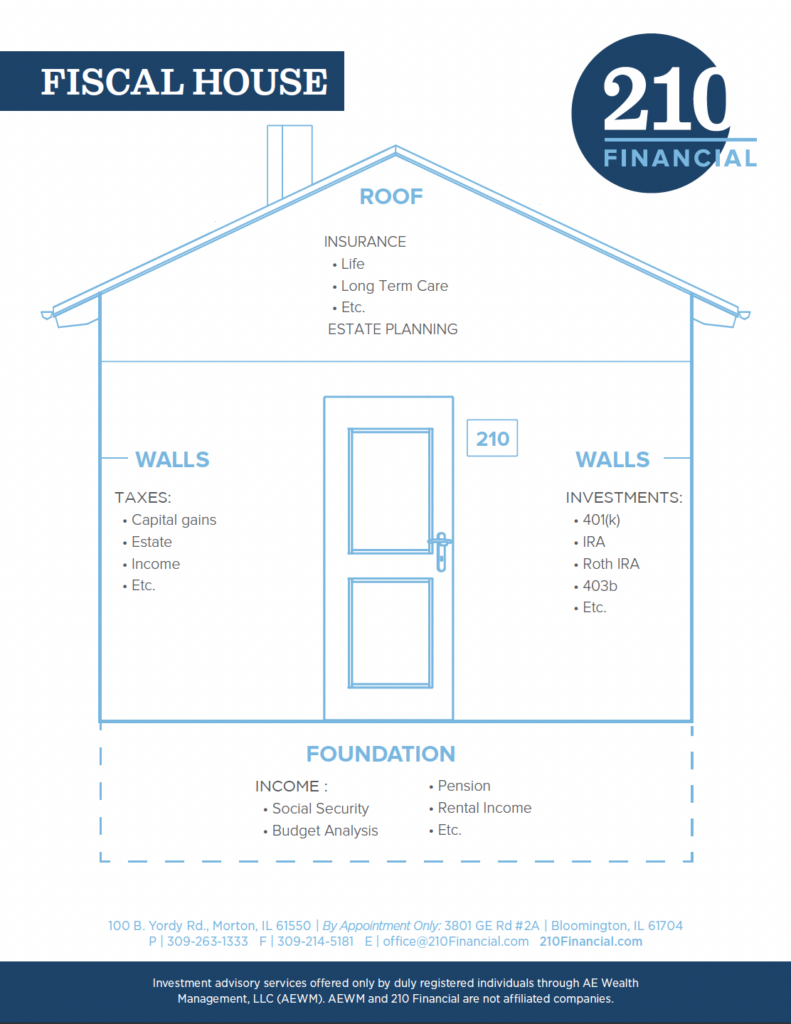

If you’ve stopped by any of our 210 offices or had a meeting with one of our financial advisors, then you might have seen our “Fiscal House” blueprint. This is a visual we like to use to help people understand how we create a plan for their retirement. If you haven’t seen it before, then we are going to let you in on a 210 tradition by sharing our blueprint for retirement here!

The Blueprint

This blueprint is made up of five different steps to help you create a strong and stable financial plan. In order to understand how each of these areas relates to your retirement planning, let’s take a closer look at them and what each one represents.

1) The Foundation: Income

Just like your home, building a strong financial plan starts with the foundation. The foundation in this case represents your income; without this, you can’t develop the rest of your plan. So whether you are planning on getting your income in retirement from Social Security, a pension, rental income, a part-time job, or a mix of many sources, we have to make sure you have enough income to meet your needs in retirement.

2) The Walls: Investment Planning

Next are the walls—this is your investment planning. In a home, you need to be sure your walls won’t cave in, but you’ll probably change the paint colors now and then. It’s the same way with your investment planning. We like to use the Rule of 100 to help determine how much risk your plan’s walls can have and still stand up, but it’s important in any plan to be willing to adjust the risk as needed to make the most sense for your current situation.

LISTEN: Income, RMDs, Beneficiaries, & Portfolio Risk: A Grabbag – Episode 12

3) Windows and Doors: Tax Planning

This house also has windows and a door, which represent tax planning. Just like the windows and door of a physical house, we won’t be changing them out very often (if at all!). Once you have a tax plan in place, you’ll tend to stick to it. There are some instances where you might consider changing out a window or two—a good example of this would be something like converting an IRA to a Roth IRA to pay taxes now while they are low in comparison to past years.

4) First-Level Roof: Healthcare

After you have taken the time to lay a solid income foundation, build the walls of investment, and determine your strategy for tax planning, it’s time to put a roof on your house.

The roof is made up of two parts that help protect the house we have built. Those two parts are healthcare and legacy planning.

Healthcare includes everything related to your healthcare needs. Will you need to pay for coverage before Medicare kicks in? Do you expect to need long-term care insurance? How much life insurance should you have? These are all things you should consider and plan for with your financial advisor to build this half of the roof.

5) Second-Level Roof: Legacy Planning

The second portion of the roof is what we refer to as legacy planning. Legacy planning covers how we are going to get the maximum amount of your resources passed on to the next generation after you have passed. This could be property, money, investments, or even businesses.

You can use what you’ve built to richly bless those that come after us and leave a meaningful legacy that may even inspire a domino effect for generations to come.

LISTEN: Why You Should Get Serious About Life Insurance – Episode 21

Start Building Your Financial House

Having a plan to cover each area of retirement is important in reaching your goals for retirement. Regardless of what stage of life you are in, it is never too late to start building your financial house. However, there are different ways we would recommend executing these strategies depending on your age, life circumstances, and financial situation.

If you would like to know more about our blueprint for retirement or how your current retirement plan measures up, schedule your free Retirement Blueprint Financial Review today!

210 Financial is more than just numbers. The “210” in our name stands for a childhood home that represented safety, love, and family. That is what we want to provide for everyone that we care for. Welcome home. Welcome to 210.

Insurance products are offered through the insurance business 210 Financial. 210 Financial is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Advisor. AEWM does not offer insurance products. The insurance products offered by 210 Financial are not subject to Investment Advisor requirements. 1992226-9/23

Content prepared by Savage Content Collective

Ready to Take The Next Step?

For more information about our comprehensive financial planning process, schedule a meeting or register to attend an event.

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out:

Tax laws change every year — and this year is no different! This downloadable guide will walk you through the latest tax law changes to help you avoid any surprises. In this 12-page guide, you will find out: