How Can Real Estate Fit Into Your Investment Portfolio? (& How to Get Started) – Episode 25

It’s time for another solo episode with Kendall! In this episode, he is talking about some of his favorite things—diversifying your investment portfolio and the role real estate can play. There’s a lot of talk about whether or not you should view real estate as a good investment. Some people say it’s a ton of…

Retirement Resource Roundup: 9 Podcasts & Articles to Help You Prepare Effectively

Retirement is a topic we’re quite passionate about here at 210 Financial. The truth is that if you want to meet your retirement dreams, you have to have a plan to achieve them. So in case you’ve missed any of our retirement resources, we wanted to compile some of the popular ones in this list!…

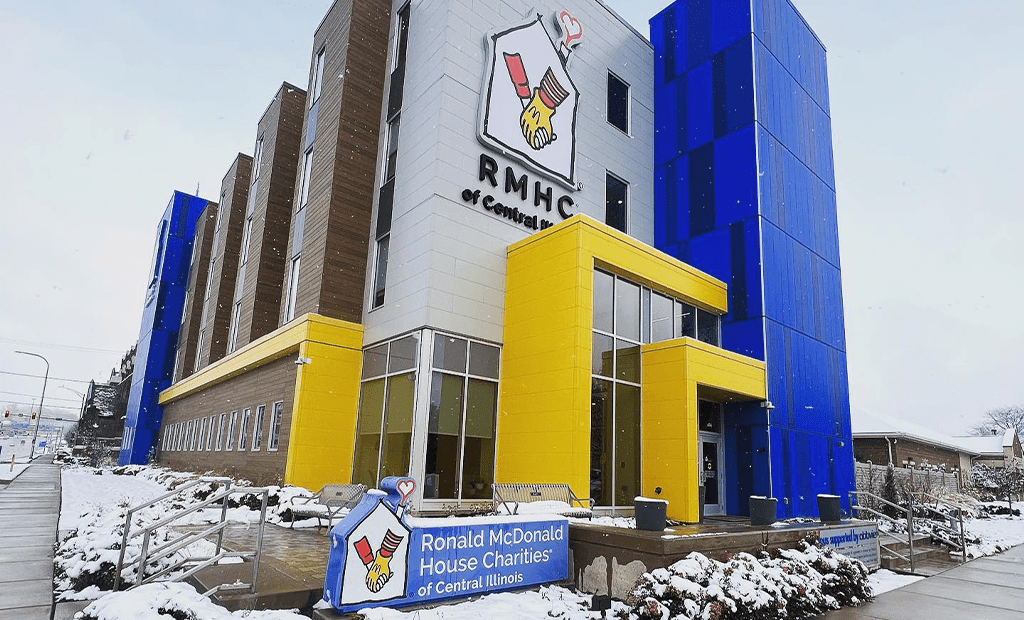

How We’re Supporting Ronald McDonald House in 2023

As is the tradition here at 210 Financial, we are passionate about integrating generosity into our business culture and as a part of our financial plan. Each year, we select a new charity for our team and clients to support through giving and volunteering. This year, our selected charity is Ronald McDonald House Charities® in…

Ways to Help Make Your Own Financial Luck

Have you ever found a twenty-dollar bill on the street? Won a prize for a giveaway or found a four-leaf clover? Odds are you felt pretty lucky! When it comes to finances, there are days when we wish we could just capture some of that luck. We find ourselves wondering, Wouldn’t it be nice if…

How to Manage Your Expenses in Retirement – Episode 24

For the majority of your life, you will work hard and pinch those pennies so that you can fund retirement. But once you actually retire, it’s time to enjoy all your hard work! Kendall has another solo episode to help you understand how to manage your expenses AND have fun in retirement! He is sharing…

Do You Have a Strategy for Tax Season?

We all know taxes aren’t fun. So here’s some tax-related jokes before we dive in: Q: Why are most accountants so good-looking? A: Because they have great figures. Q: Why does the IRS hate Sherlock Holmes? A: Because he makes too many deductions. Q: How do you know your child will be a…

New Legislation: What is the Secure Act 2.0 & What Does it Mean for You? – Episode 23

We’ve got you covered as new legislation has been passed which will take effect in 2024. This includes the Secure Act 2.0, which has over 90 provisions that could affect your taxes and financial plan. In this solo episode, Kendall will let you in on the major changes from this legislation and how that could…

The Top 10 Retirement Planning Tips in 2023 – Episode 22

Welcome back to Your Retirement Blueprint! We hope you’ve had a great start to the year. In today’s video, we’ve put together the top 10 tips for retirement planning in 2023. There is a lot of great insight packed into this one—we’ve included everything from financial strategies to potential tax considerations to maintaining your feeling…

How to Set Goals for Your Finances

Do you remember your first piggy bank? The sound of all the coins clinking together made a glorious chime indicating how close it was to be full. For many of us, this was the first financial goal we had and it taught us the power of setting goals (and the fun of smashing the piggy…

Why You Should Get Serious About Life Insurance – Episode 21

Many people don’t often think about life insurance as a major part of their financial plan. Or perhaps they only consider it as a valuable investment only when they’re younger. We believe that should change. Yes, it can be a bit depressing to have to think about the case of your own death and if…

Off the Script! Phil & Kendall’s Financial Pet Peeves – Episode 20

We ripped the script for this episode. Literally! We had a plan of what we were going to talk about, but decided to go off-book. After sharing our Question of the Day, we discuss our pet peeves when it comes to investing and financial planning (and a few random ones 🙂). For many, the pandemic…

Ready to Take The Next Step?

For more information about our comprehensive financial planning process, schedule a meeting or register to attend an event.